pinellas county sales tax calculator

Within Pinellas Park there are around 3 zip codes with the most populous zip code being 33781. Puerto Rico has a 105 sales tax and Pinellas County collects an additional 1 so the minimum sales tax rate in Pinellas County is 7 not including any city or special district taxes.

Sales Tax In Hillsborough County To Increase Jan 1

The Pinellas County Sales Tax is collected by the merchant on all qualifying sales made within Pinellas County.

. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Pinellas County. See If You Qualify. What is the sales tax rate in Pinellas County.

And instantly calculate sales taxes in every state. A full list of these can be found below. The Pinellas Park sales tax rate is.

Groceries are exempt from the Pinellas County and Florida state sales taxes. This rate includes any state county city and local sales taxes. The most populous location in Pinellas County Florida is Saint Petersburg.

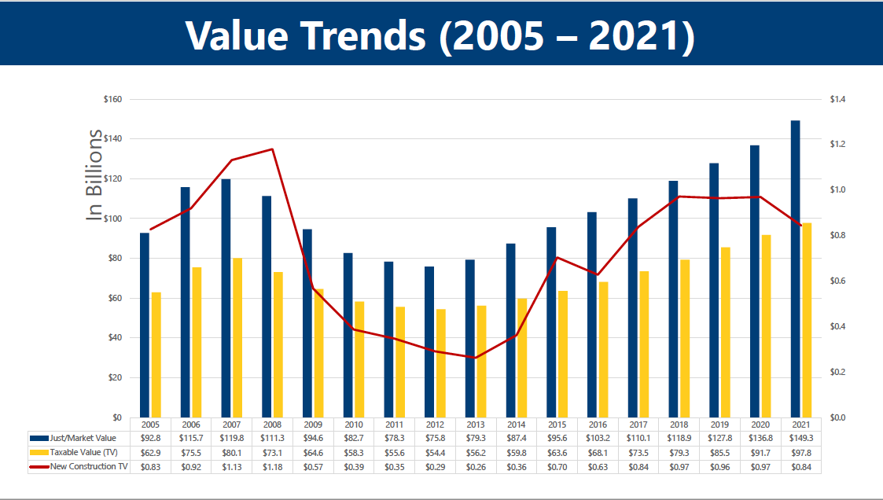

JustMarket Value limited by the Save Our Homes Cap or 10 Cap Assessed Value. The average cumulative sales tax rate in Pinellas Park Florida is 7. This table shows the total sales tax rates for all cities and towns in Pinellas.

This includes the rates on the state county city and special levels. The median property tax on a 18570000 house is 194985 in the United States. The December 2020 total local sales tax rate was also 7000.

Whether you are already a resident or just considering moving to Pinellas County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. 1st installment payment for 2022 property taxes due by June 30. The sales tax rate does not vary based on zip code.

The most populous zip code in Pinellas County Florida is 34698. The median property tax in Pinellas County Florida is 1699 per year for a home worth the median value of 185700. The Florida state sales tax rate is currently.

As for zip codes there are around 71 of them. 727 464-3448 TTY. What is the sales tax rate in Pinellas Park Florida.

Sales comparisons appraise market values utilizing recent sales data while unequal appraisals highlight. This is the total of state and county sales tax rates. This is the total of state county and city sales tax rates.

How much is sales tax in Pinellas County in Florida. Did South Dakota v. Ad Having to Collect and Remit Sales Tax in More States Now That Remote Sales Are Taxable.

You can find more tax rates and allowances for Pinellas County and Florida in the 2022 Florida Tax Tables. Learn all about Pinellas County real estate tax. The median property tax in Pinellas County Florida is 1699 per year for a home worth the median value of 185700.

The latest sales tax rate for Pinellas Park FL. Sales Tax Calculator Sales Tax Table. FL Rates Calculator Table.

8AM TO 5PM MON - FRI. The total sales tax rate in any given location can be broken down into state county city and special district rates. Assessed Value - Exemptions Taxable Value.

Pinellas Park is located within Pinellas County Florida. Pinellas County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Pinellas County totaling 1. The minimum combined 2022 sales tax rate for Pinellas County Florida is.

Update Address with the Property Appraiser. Going Out Of Business. 727 464-3370 HOURS.

Avalara Will Calculate Tax and File Your Returns in 24 States for Free. The Florida sales tax rate is currently. If this rate has been updated locally.

Sales tax dealers must collect both discretionary sales surtax and the state sales tax from the purchaser at the time of sale and remit the taxes. 727 464-3207 FAX. The 2018 United States Supreme Court decision in South Dakota v.

Tax Certificate Tax Deed. SalesTaxHandbook visitors qualify for a. The minimum combined 2022 sales tax rate for Pinellas Park Florida is.

In addition to the state sales and use tax rate individual Florida counties may impose a sales surtax called discretionary sales surtax or local option county sales tax. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Choose a value Commercial Residential.

Sales tax in Pinellas County Florida is currently 7. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. The County sales tax rate is.

The Pinellas County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Pinellas County local sales taxesThe local sales tax consists of a 100 county sales tax. Calculations effective October 15 2017. Pinellas County has one of the highest median property taxes in the United States and is ranked 640th of the 3143 counties in order of median property taxes.

We want you to be fully informed about Floridas property tax laws so you can enjoy your dream home as a resident of Pinellas County for many years to come. The average cumulative sales tax rate between all of them is 7. 2020 rates included for use while preparing your income tax deduction.

Official 2022 tax roll opens Nov 1. The sales tax rate for Pinellas County was updated for the 2020 tax year this is the current sales tax rate we are using in the Pinellas County Florida Sales Tax Comparison Calculator for 202223. Taxable Value x Millage Rate 1000 Gross taxes On January 29 2008 Florida voters approved an additional 25000 homestead exemption to be applied to the value between 50000 and 75000.

US Sales Tax Rates FL Rates Sales Tax Calculator Sales Tax Table. The local sales tax rate in Pinellas County is 1 and the maximum rate including Florida and city sales taxes is 75 as of July 2022. Property Taxes in Pinellas County.

The Pinellas County sales tax rate is. Integrate Vertex seamlessly to the systems you already use. The current total local sales tax rate in Pinellas County FL is 7000.

Pinellas County has one of the highest median property taxes in the United States and is ranked 640th of the 3143 counties in order of median property taxes. Ad Automate Standardize Taxability on Sales and Purchase Transactions. Pinellas County Building Permit Fee Calculator.

Actual property tax assessments depend on a number of variables. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Receiving Money into Court Registry.

The sales tax rate does not vary based on location. Pinellas County collects on average 091 of a propertys assessed fair market value as property tax.

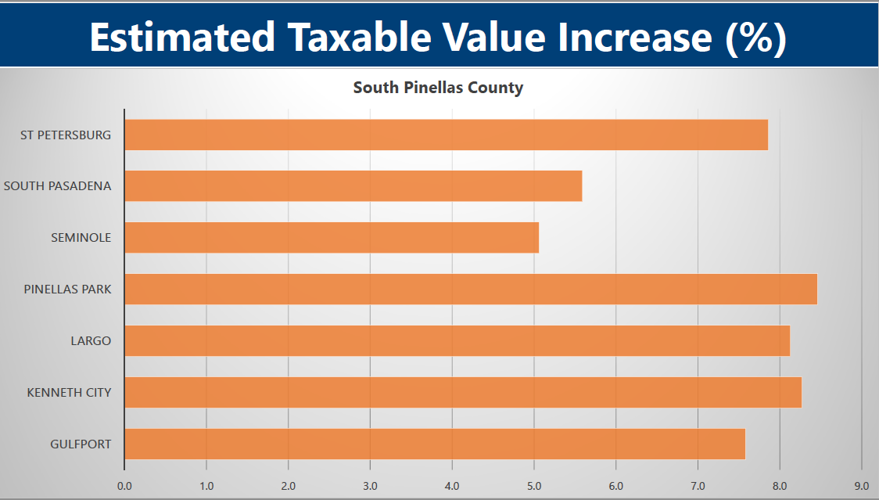

Pinellas Property Values Keep Climbing Beaches Tbnweekly Com

Hillsborough Pinellas Median Home Prices 2021 Statista

Florida Income Tax Calculator Smartasset

Florida Income Tax Calculator Smartasset

Duval School Board Votes 6 1 To Put Property Tax Onto August Ballot Wjct News

33759 Sales Tax Rate Fl Sales Taxes By Zip

Business Tax Summary Pinellas County Economic Development Pced

Florida Sales Tax Guide For Businesses

Property Taxes Expected To Spike For New Homeowners

Florida Income Tax Calculator Smartasset

Pinellas Property Values Keep Climbing Beaches Tbnweekly Com

Small Business Taxes Florida Restaurant Sales Tax Bracket System Delucia Co

Gilchrist County Fl Property Tax Search And Records Propertyshark